UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE l4A

(Rule 14a-101)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Under Rule l4a-l2 |

CINEDIGM CORP.

(Name of Registrant As Specified In Its Charter)

| N/A |

| (Name of Person(s) Filing Proxy statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth in the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

CINEDIGM CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On August 31, 2017December 4, 2019

Dear Fellow Stockholders:

We invite you to attend the 20172019 Annual Meeting of Stockholders of Cinedigm Corp., a Delaware corporation (the “Company”), which will be held on August 31, 2017,December 4, 2019, at 2:00 p.m., local time (the “Annual Meeting”), at the Community Room at Sherman Oaks Galleria, located on the first leveloffices of the Rotunda, 15301 VenturaKelley Drye & Warren LLP, 10100 Santa Monica Boulevard, Sherman Oaks,Suite 2300, Los Angeles, California 91403.90067. At the Annual Meeting, you will be asked to vote on the following proposals (as more fully described in the Proxy Statement accompanying this Notice):

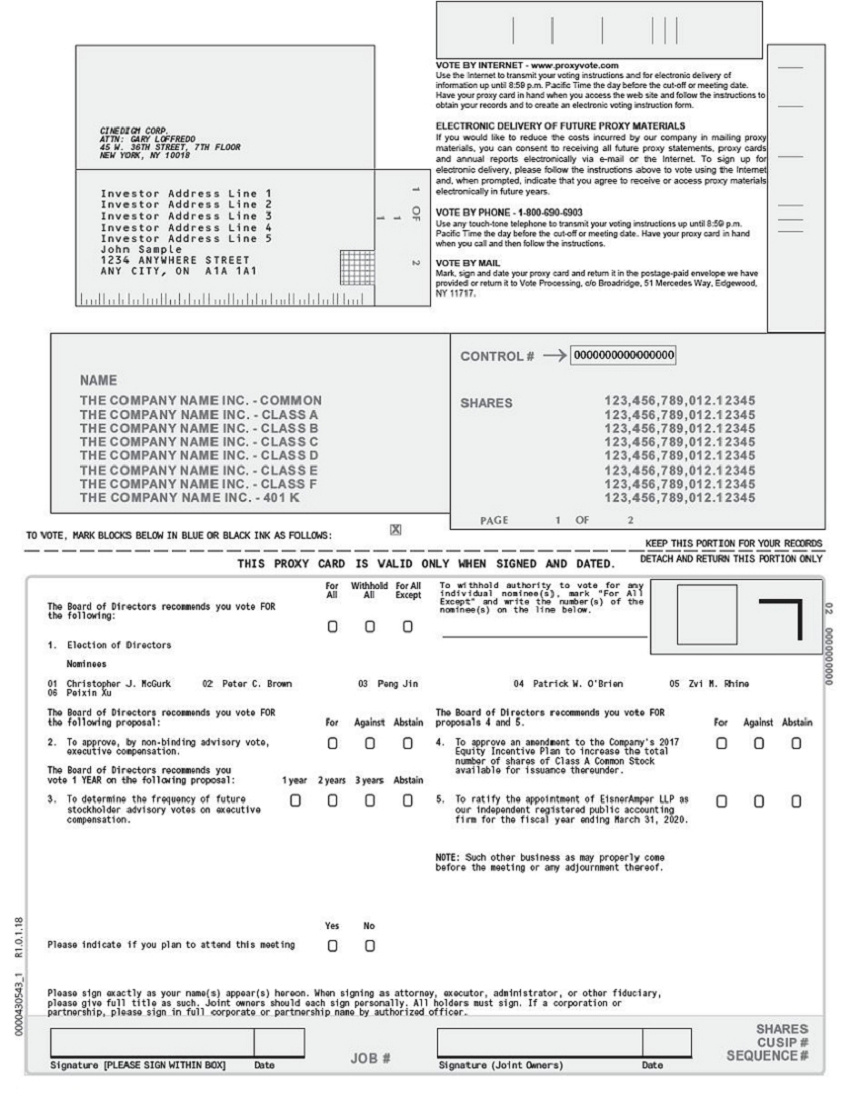

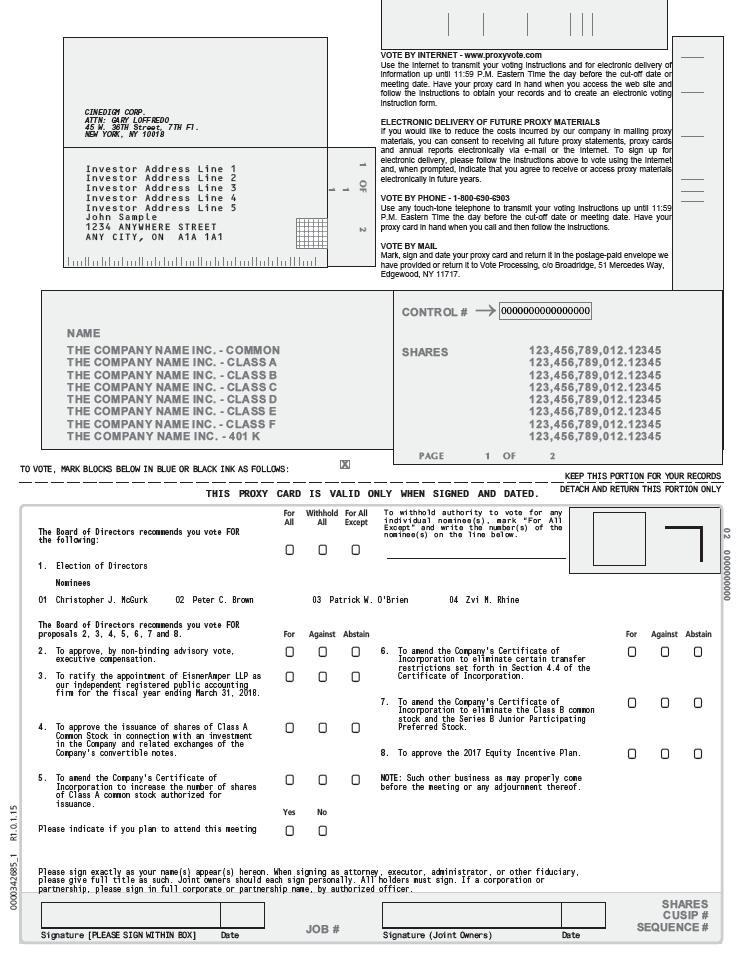

| 1. | To elect |

| 2. | To approve, by non-binding advisory vote, executive compensation. |

| 3. |

| 4. | To approve an amendment to the Company's 2017 Equity Incentive Plan to increase the total number of shares of Class A Common Stock available for issuance thereunder. |

| 5. | To ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the fiscal year ending March 31, |

| 6. |

| To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only stockholders of record at the close of business on July 24, 2017October 8, 2019 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

YOUR VOTE IS VERY IMPORTANT. WE HOPE YOU WILL ATTEND THIS ANNUAL MEETING IN PERSON. HOWEVER, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY VOTE YOUR SHARES VIA THE INTERNET OR THE TOLL-FREE NUMBER AS DESCRIBED IN THE ENCLOSED MATERIALS. IF YOU RECEIVED A PROXY CARD BY MAIL, PLEASE SIGN, DATE AND RETURN IT IN THE ENVELOPE PROVIDED. IF YOU RECEIVED MORE THAN ONE PROXY CARD, IT IS AN INDICATION THAT YOUR SHARES ARE REGISTERED IN MORE THAN ONE ACCOUNT. PLEASE COMPLETE, DATE, SIGN AND RETURNEACH PROXY CARD YOU RECEIVE. IF YOU ATTEND THE ANNUAL MEETING AND VOTE IN PERSON, YOUR VOTE BY PROXY WILL NOT BE USED.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| Christopher J. McGurk | |

| Chairman of the Board of Directors |

New York, New York

Date: August 7, 2017October22, 2019

CINEDIGM CORP.

45 West 36th Street, 7thFloor

New York, New York 10018

PROXY STATEMENT

20172019 ANNUAL MEETING OF STOCKHOLDERS

August 31, 2017December 4, 2019

GENERAL

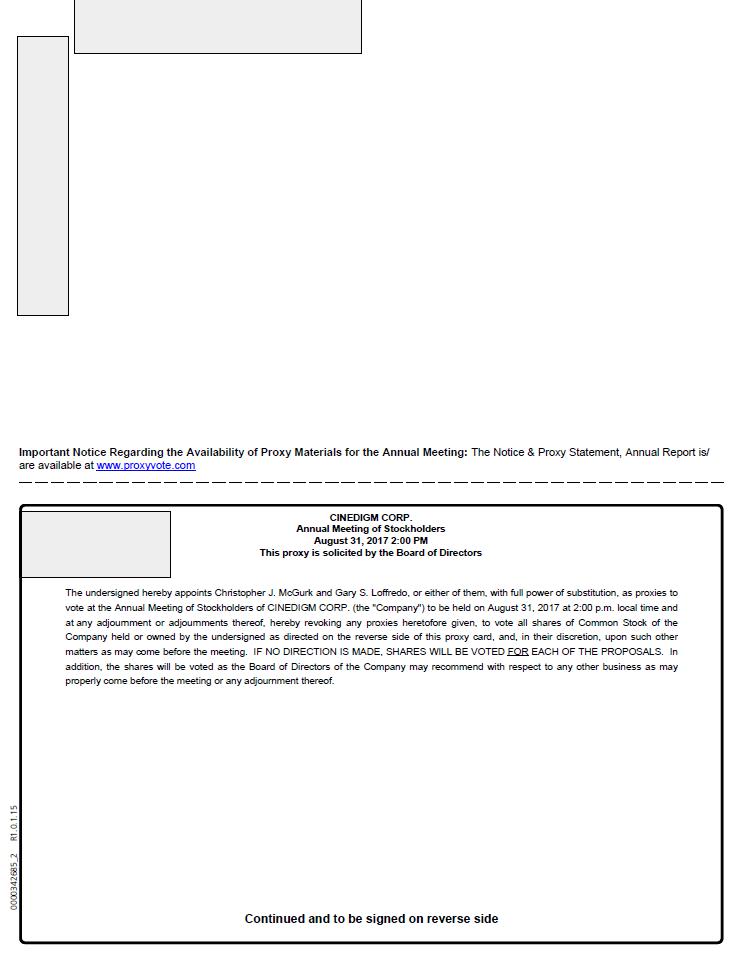

This Proxy Statement is being furnished to the stockholders of CINEDIGM CORP. (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”). The proxies are for use at the 20172019 Annual Meeting of Stockholders of the Company to be held on August 31, 2017,December 4, 2019, at 2:00 p.m., local time, or at any adjournment thereof (the “Annual Meeting”). The Annual Meeting will be held at the Community Room at Sherman Oaks Galleria, located on the first leveloffices of the Rotunda, 15301 VenturaKelley Drye & Warren LLP, 10100 Santa Monica Boulevard, Sherman Oaks,Suite 2300, Los Angeles, California 91403.90067. The Company’s telephone number is (212) 206-8600.

The shares represented by your proxy will be voted at the Annual Meeting as therein specified (if the proxy is properly executed and returned, and not revoked).

The shares represented by your proxy will be voted as indicated on your properly executed proxy. If no directions are given on the proxy, the shares represented by your proxy will be voted:

FOR the election of the director nominees named herein (Proposal One), unless you specifically withhold authority to vote for one or more of the director nominees, if you are a record holder of your shares. If you hold your shares through a broker in “street name,” your broker will not be allowed to vote on Proposal One unless you direct your broker as to such vote.

FOR the approval of the non-binding advisory vote on executive compensation (Proposal Two).

FOR a frequency of “1 YEAR” for future stockholder advisory votes on executive compensation (Proposal Three).

FOR authorizing an amendment to the Company's 2017 Equity Incentive Plan to increase the total number of shares of Class A Common Stock available for issuance thereunder. (Proposal Four).

FORratifying the appointment of EisnerAmper LLP as our independent registered public accounting firm for the fiscal year ending March 31, 20182020 (Proposal Three).

FOR the approval of the issuance of shares of Class A common stock in connection with an investment in the Company and related exchanges of the Company’s convertible notes (Proposal Four).

FORamending the Company’s Certificate of Incorporation to increase the number of shares of Class A common stock authorized for issuance (Proposal Five).

FOR amending the Company’s Certificate of Incorporation to eliminate certain transfer restrictions set forth in Section 4.4 of the Certificate of Incorporation (Proposal Six).

FOR amending the Company’s Certificate of Incorporation to eliminate the Class B common stock and the Series B Junior Participating Preferred Stock (Proposal Seven).

FOR the approval of the 2017 Equity Incentive Plan (Proposal Eight).

The Company knows of no other matters to be submitted to the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the shares they represent as the Board may recommend.

These proxy solicitation materials are first being mailed to the stockholders on or about August 7, 2017.October 22, 2019.

VOTING SECURITIES

Stockholders of record at the close of business on July 24, 2017October 8, 2019 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 13,611,67939,689,387 shares of the Company’s Class A Common Stock, $0.001 par value (“Class A Common Stock”), were issued and outstanding.

Each holder of Class A Common Stock is entitled to one vote for each share of Class A Common Stock held as of the Record Date.

QUORUM; ABSTENTIONS; BROKER NON-VOTES

A majority of the aggregate voting power of the outstanding shares of Class A Common Stock as of the Record Date must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. If the aggregate voting power of the shares of Class A Common Stock present, in person and by proxy, at the Annual Meeting does not constitute the required quorum, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

Shares of Class A Common Stock that are voted “FOR,” “AGAINST” or “ABSTAIN” are treated as being present at the Annual Meeting for purposes of establishing a quorum. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” with respect to a matter will also be treated as shares entitled to vote at the Annual Meeting (the “Votes Cast”) with respect to such matter. Abstentions will be counted for purposes of quorum and will have the same effect as a vote “AGAINST” a proposal.

Broker non-votes (i.e., votes fromfor shares of Class A Common Stock held as of the Record Date by brokers or other custodians as to which the beneficial owners have given no voting instructions) will be counted as “shares present” at the Annual Meeting for purposes of determining the presence or absence of a quorum for the transaction of business so long as the broker can vote on any proposal being considered. However, brokers cannot vote on their clients’ behalf on “non-routine” proposals for which they have not received voting instructions from their clients for such proposals. The vote on Proposals 1, 2, 4, 5, 6, 7One, Two, Three and 8Four are considered “non-routine.” Accordingly, broker non-votes will not have any effect with respect to Proposals 1, 2, 4, 5, 6, 7 or 8,One, Two, Three, and Four as shares that constitute broker non-votes are not considered entitled to vote on these matters.

Brokers do have authority to vote uninstructed shares for or against “routine” proposals. Proposal ThreeFive constitutes a “routine” proposal. Accordingly, a broker may vote uninstructed shares “FOR” or “AGAINST” Proposal Three.Five.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS TO BE PRESENTED AT NEXT ANNUAL MEETING

In order for any stockholder proposal submitted pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to be included in the Company’s Proxy Statement to be issued in connection with the 20182020 Annual Meeting of Stockholders, such stockholder proposal must be received by the Company no later than April 9, 2018.June 24, 2020. Any such stockholder proposal submitted, including any accompanying supporting statement, may not exceed 500 words, as per Rule 14a-8(d) of the Exchange Act. Any such stockholder proposals submitted outside the processes of Rule 14a-8 promulgated under the Exchange Act, which a stockholder intends to bring forth at the Company’s 20182020 Annual Meeting of Stockholders, will be untimely for purposes of Rule 14a-4 of the Exchange Act if received by the Company after June 23, 2018.September 6, 2020. All stockholder proposals must be made in writing addressed to the Company’s Secretary, Mr. Loffredo, at 45 West 36th Street, 7thFloor, New York, New York 10018.

REVOCABILITY OF PROXY

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company’s Secretary, Mr. Loffredo, a written notice of revocation, a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Attending the Annual Meeting in and of itself will not constitute a revocation of a proxy.

DISSENTERS’ RIGHT OF APPRAISAL

Under Delaware General Corporation Law and the Company’s Fifth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Annual Meeting.

SOLICITATION

Proxies may be solicited by certain of the Company’s directors, executive officers and regular employees, without additional compensation, in person, or by telephone, e-mail or facsimile. In addition, the Company has engaged D.F. King, a professional proxy solicitation firm, to provide customary solicitation services for a fee of $10,500 plus out-of-pocket expenses. The cost of soliciting proxies will be borne by the Company. The Company expects to reimburse brokerage firms, banks, custodians and other persons representing beneficial owners of shares of Class A Common Stock for their reasonable out-of-pocket expenses in forwarding solicitation material to such beneficial owners.

Some banks, brokers and other record holders have begun the practice of “householding” notices, proxy statements and annual reports. “Householding” is the term used to describe the practice of delivering a single set of notices, proxy statements and annual reports to any household at which two or more stockholders reside if a company reasonably believes the stockholders are members of the same family. This procedure reduces the volume of duplicate information stockholders receive and also reduces a company’s printing and mailing costs. The Company will promptly deliver an additional copy of any such document to any stockholder who writes or calls the Company. Alternatively, if you share an address with another stockholder and have received multiple copies of our notices, proxy statements and annual reports, you may contact us to request delivery of a single copy of these materials. Any such written request should be directed to Investor Relations at 45 West 36th Street, 7thFloor, New York, New York 10018 or (212) 206-8600.

DELIVERYAVAILABILITY OF PROXY MATERIALS

ThisOur proxy materials are primarily available to stockholders on the Internet, as permitted by the rules of the Securities and Exchange Commission (the “SEC”). A Notice of Internet Availability of Proxy Materials will be mailed to stockholders beginning approximately October 22, 2019, and this Proxy Statement and form of proxy, together with our Annual Report on Form 10-K, are first being deliveredmade available to stockholders beginning on or about August 7, 2017.approximately October 22, 2019. The Annual Report, which is includedhas been posted along with this Proxy Statement, is not a part of the proxy solicitation materials. Upon receipt of a written request, the Company will furnish to any stockholder,shareholder, without charge, an additionala copy of such Annual Report.Report (without exhibits). Upon request and payment of $0.10 (ten cents) per page, copies of any exhibit to such Annual Report will also be provided. Any such written request should be directed to the Company’s Secretary at 45 West 36th Street, 7thFloor, New York, New York 10018 or (212) 206-8600. These documents are also included in our filings with the Securities and Exchange Commission (the “SEC”),SEC, which you can access electronically at the SEC's website athttp://www.sec.gov.www.sec.gov.

ELECTRONIC ACCESS TO PROXY MATERIALS

In addition to this printed form of proxy,This year we are also furnishingpleased to apply the SEC rule that allows companies to furnish proxy materials to stockholders primarily over the Internet. We believe this method should expedite receipt of your proxy materials, lower costs of our Annual Meeting and help conserve natural resources. We encourage you to vote via the Internet by following the links to the Proxy Statement and Annual Report, which are both available atwww.proxyvote.comwww.proxyvote.com.. This Proxy Statement and the Annual Report are also available on the Company’s website at http://www.cinedigm.com/.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board currently consists of four (4)six (6) directors. All of the current members of the Board have been nominated for re-election. Stockholders and their proxies cannot vote for more than four (4)six (6) nominees at the Annual Meeting. Each nominee has consented to being named as a nominee for election as a director and has agreed to serve if elected; however, if a nominee should withdraw his or her name from consideration for any reason or otherwise become unable to serve before the Annual Meeting, the Board reserves the right to substitute another person as nominee, and the persons named on your proxy card as proxies will vote for any substitute nominated by the Board. At the Annual Meeting, directors will be elected to serve one-year terms expiring at the next annual meeting of stockholders or until their successors are elected or until their earlier resignation or removal. This Proposal One relates to the election of directors to take effect immediately upon the Annual Meeting, regardless of whether the transactions described in Proposal Four are approved and consummated.Meeting.

The directors shall be elected by a majority of the Votes Cast at the Annual Meeting in accordance with our by-laws. If any nominee is not available for election at the time of the Annual Meeting (which is not anticipated), the proxy holders named in the proxy, unless specifically instructed otherwise in the proxy, will vote for the election of such other person as the existing Board may recommend, unless the Board decides to reduce the number of directors of the Company. Certain information about the nominees to the Board is set forth below.

Christopher J. McGurk, 60,62, has been the Company’s Chief Executive Officer and Chairman of the Board since January 2011. Mr. McGurk was the founder and Chief Executive Officer of Overture Films from 2006 until 2010 and also the Chief Executive Officer of Anchor Bay Entertainment, which distributed Overture Films’ products to the home entertainment industry. From 1999 to 2005, Mr. McGurk was Vice Chairman of the Board and Chief Operating Officer of Metro-Goldwyn-Mayer Inc. (“MGM”), acting as the company’s lead operating executive until MGM was sold for approximately $5 billion to a consortium of investors. Mr. McGurk joined MGM from Universal Pictures, where he served in various executive capacities, including President and Chief Operating Officer, from 1996 to 1999. From 1988 to 1996, Mr. McGurk served in several senior executive roles at The Walt Disney Studios, including Studios Chief Financial Officer and President of The Walt Disney Motion Picture Group. Mr. McGurk has previously served on the boards of BRE Properties, Inc., DivX Inc., DIC Entertainment, Pricegrabber.com, LLC and MGM Studios, Inc. Mr. McGurk’s extensive career in various sectors of the theatrical production and exhibition industry will provide the Company with the benefits of his knowledge of and experience in this field, as well as his wide-spread contacts within the industry.

Peter C. Brown, 58,61, has been a member of the Board since September 2010. He is Chairman of Grassmere Partners, LLC, a private investment firm, which he founded in 2009. Prior to founding Grassmere Partners, Mr. Brown served as Chairman of the Board, Chief Executive Officer and President of AMC Entertainment Inc. (“AMC”), one of the world’s leading theatrical exhibition companies, from July 1999 until his retirement in February 2009. He joined AMC in 1990 and served as AMC’s President from January 1997 to July 1999 and Senior Vice President and Chief Financial Officer from 1991 to 1997. Mr. Brown currently serves on the board of EPR Properties (NYSE: EPR), a specialty real estate investment trust (REIT). Mr. Brown also serves as a director of CenturyLink (NYSE: CTL), a global leader in communications, hosting, cloud and IT services. Past additional public company boards include: National CineMedia, Inc., Midway Games, Inc., LabOne, Inc., and Protection One, Inc. Mr. Brown’s extensive experience in the theatrical exhibition and entertainment industry and other public company boards provides the Board with valuable knowledge and insight relevant to the Company’s business.

Peng Jin,43, has been a member of the Board since November 2017. Mr. Jin has been a managing partner of Bison Capital Holding Company Limited (“Bison”) since August 2014, and a director since March 2017. From 2008 to 2014, Mr. Jin served as a partner of Keystone Ventures. Mr. Jin is a designee of Bison in connection with the Stock Purchase Agreement (the “Bison Agreement”) dated as of June 29, 2017, by and between the Company and Bison Entertainment Investment Limited, a wholly owned subsidiary of Bison. Mr. Jin brings to the Board investment experience, including in the media industry, in the United States and in China.

Patrick W. O’Brien, 70,73, has been a member of the Board since July 2015. He currently serves as the Managing Director & Principal of Granville Wolcott Advisors, a company he formed in 2009 which provides business consulting, due diligence and asset management services for public and private clients. From 2005 to 2009, Mr. O’Brien was a Vice President - Asset Management for Bental-Kennedy Associates Real Estate Counsel where he represented pension fund ownership interests in hotel real estate investments nationwide. Mr. O’Brien also serves on the board of directors of LVI Liquidation Corp., Creative Realities, Inc., and Fit Boom Bah. During the past five years, Mr. O’Brien served on the boards of Ironclad Performance Wear, Inc.ICPW Liquidation Trust and Merriman Holdings, Inc..Inc. Mr. O’Brien joined the Board as a designee of Ronald L. Chez pursuant to the Settlement Agreement dated as of July 30, 2015 among the Company and certain stockholders party thereto. He brings to the Board his seasoned executive and business expertise in private and public companies with an emphasis on financial analysis and business development.

Zvi M. Rhine, 37,40, has been a member of the Board since July 2015. He is the principal and managing member of Sabra Capital Partners which he founded in 2012, a multi-strategy hedge fund that focuses on event-driven, value and special situations investments primarily in North America. He was previously Vice President at The Hilco Organization from 2009 to 2012 and has also served in various roles at Boone Capital, Banc of America Securities and Piper Jaffray. Mr. Rhine also serves as the CFO and a director of Global Healthcare Real Estate Investment Trust. Mr. Rhine brings to the Board extensive experience in the securities industry.

Peixin Xu, 47, has been a member of the Board since November 2017. Mr. Xu founded Bison, an investment company with a focus on the media and entertainment, healthcare and financial service industries in 2014 and has been serving as a partner and director since then. From 2013 to the present, Mr. Xu has been serving on the board of directors of Airmedia Group Inc. (Nasdaq: AMCN). Mr. Xu is a designee of Bison in connection with the Bison Agreement. Mr. Xu brings to the Board investment experience, including in the media industry, in the United States and in China.

In connection with the consummation of the transactions contemplated by the Bison Agreement, certain members of the Board and management, representing approximately 4.1% of the shares of Class A common stock available to be voted at the Annual Meeting, agreed to vote shares of Common Stock owned or controlled by each such holder in favor of Bison’s designees to the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE.

PROPOSAL TWO

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

SEC rules adopted pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010 (the “Dodd-Frank Act”), enable our stockholders to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement.

As described in detail in the section entitled “Compensation Discussion and Analysis”, we believe that executive compensation should be focused on promoting Company performance and stockholder value. To achieve these goals our executive compensation program emphasizes pay for performance and aligning the interests of our executives with those of our stockholders through the use of long-term incentives and the encouragement of equity ownership. In addition, our executive compensation program is designed to allow us to recruit, retain and motivate employees who play a significant role in our current and future success. Please read the Compensation Discussion and Analysis, the 20172019 Summary Compensation Table and the other related tables and accompanying narrative for a detailed description of the fiscal year 20172019 compensation of our named executive officers. We believe that the 20172019 compensation of each of our named executive officers was reasonable and appropriate and aligned with the Company’s 20172019 results and the achievement of the objectives of our executive compensation program.

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the overall compensation of our named executive officers. This vote is advisory only and is not binding on the Company or the Board. Although the vote is non-binding, our Board values the opinions of our stockholders and the Board and the Compensation Committee will consider the outcome of the vote when making future compensation decisions for our named executive officers.

This proposal requires approval by a majority of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote thereat.

Accordingly, we ask our stockholders to vote in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 20172019 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

5

THE BOARD RECOMMENDS A VOTE “FOR” APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL THREERATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board has selected the firm of EisnerAmper LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018, subject to ratification by our stockholders at the Annual Meeting. EisnerAmper LLP has been our independent registered public accounting firm since the fiscal year ended March 31, 2006. No representative of EisnerAmper LLP is expected to be present at the Annual Meeting.

This proposal requires approval by a majority of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote thereat.

More information about our independent registered public accounting firm is available under the heading “Independent Registered Public Accounting Firm” on page 40 below.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOUADVISORY VOTE “FOR” THE RATIFICATIONON FREQUENCY OF THE APPOINTMENT OF EISNERAMPER LLP AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING MARCH 31, 2018.

PROPOSAL FOUR

APPROVAL OF THE ISSUANCE OF SHARES OF CLASS A COMMON STOCK IN CONNECTION WITH AN INVESTMENT IN THE COMPANY AND RELATED EXCHANGES OF THE COMPANY’S CONVERTIBLE NOTES.

The Company is seeking stockholder approval for the issuance and sale of Class A Common Stock in connection with a series of transactions that, if consummated, will result in a change of control of the Company based on a new investor owning a majority of the then-outstanding Class A Common Stock.

The transactions consist of: (x) the issuance and sale of 20,000,000 shares of Class A Common Stock (the “Bison Shares”) to Bison Entertainment Investment Limited, a wholly-owned subsidiary of Bison Capital Holding Ltd. (“Bison Capital”) for an aggregate purchase price of $30,000,000, of which up to 400,000 shares of Common Stock may be purchased by Company’s management instead of Bison Capital, pursuant to that certain Stock Purchase Agreement (the “Stock Purchase Agreement”) dated as of June 29, 2017 by and between the Company and Bison Capital (the “Bison Transaction”) and (y) the exchange, pursuant to two exchange agreements (the “Exchange Agreements”), of 99%,or approximately $50,000,000, of the Company’s outstanding 5.5% Convertible Notes due 2035 (the “Convertible Notes”) with the holders thereof for cash, shares of Class A Common Stock and second lien notes (the “Second Lien Notes”) pursuant to the Company’s Second Lien Loan Agreement dated as of July 14, 2016 among the Company, Cortland Capital Market Services LLC, as Agent, and the lenders party thereto (the “Second Lien Loan Agreement”) or a combination thereof (the “Note Exchanges” and together with the Bison Transaction, the “Transactions”). For purposes of this Proposal Four, the Company is seeking stockholder approval for the issuance of 20,000,000 shares of Class A Common Stocks, which represents the maximum number of shares of Common Stock issuable pursuant to the Stock Purchase Agreement.

Upon the issuance of the Bison Shares, Bison Capital will own a majority of the outstanding Class A Common Stock and will be entitled to designate two (2) members of the Company’s Board of Directors, the size of which will be set at seven (7) members. The Board of Directors currently has, and has nominated for election at the Annual Meeting, four (4) directors; if this Proposal Four is approved and the Transactions are consummated, the Board will have six (6) directors and one vacancy. Bison Capital’s designees will be appointed to serve until the next annual or other meeting of stockholders at which directors are to be elected. Thereafter, (x) while Bison Capital beneficially owns more than 28% of the outstanding Class A Common Stock, it will be entitled to designate two (2) designees to be nominated for election as a member of the Board of Directors at any meeting of stockholders at which directors are to be elected, (y) while Bison Capital beneficially owns less than 28% but at least 10% of the outstanding Class A Common Stock, it will be entitled to designate one (1) designee to be nominated for election as a member of the Board of Directors at any meeting of stockholders at which directors are to be elected, and (z) when Bison Capital beneficially owns less than 10% of the outstanding Class A Common Stock and at all times thereafter, it will be entitled to designate no designee to be nominated for election as a member of the Board of Directors. In each case, beneficial ownership shall be determined in accordance with Rule 13d-3 promulgated under the Exchange Act. For purposes of this Proposal Four, the Company is seeking stockholder approval for the issuance of up to 20,000,000 shares of Class A Common Stock, which represents the maximum number of shares of Class A Common Stock that may be sold to Bison Capital pursuant to the Stock Purchase Agreement.ADVISORY VOTE ON EXECUTIVE COMPENSATION

In addition toaccordance with the initial investment in shares of Common Stock, Bison Capital has agreed to provide the CompanyDodd-Frank Act, we are providing our stockholders with a $10,000,000 loan for working capital and general corporate purposes within 60 daysnon-binding advisory vote on whether future advisory votes on executive compensation of the closing of the Transactions and to work together with the Company to continue to refinance the remaining debt of the Company.

The Bison Transaction is subject to a number of closing conditions, including closing the Note Exchanges, receipt of stockholder approval being sought in this Proposal Four, receipt of stockholder approval of a new employee stock incentive plan being soughtnature reflected in Proposal Eight, the implementation thereof and reservation of 1,980,000 shares of the Company’s Common Stock therefor, closing of the sale of up to 400,000 shares of Common Stock to the Company’s management, setting the size of the Board at seven (7) members, receipt of stockholder approval of the Fifth Amended and Restated Certificate of Incorporation being sought in Proposals Five, Six and Seven, and lender and regulatory approvals including CFIUS approval.Two above should occur every one year, two years or three years.

The Stock Purchase Agreement may be terminated prior toAfter careful consideration, the closing under certain circumstances, including failure to obtain stockholder, lender or regulatory approval ofBoard has determined that holding an advisory vote on executive compensation every year is the Transactions, if the Transactions are not closed by October 31, 2017 or upon the occurrence of material breaches or violations of the Stock Purchase Agreements or the acceptance by the Company of certain other proposals to acquire all or part of the equity or assets of the Company.

If the Stock Purchase Agreement is terminated as a result of the Company’s material breach or violation of certain representations, warranties or covenants, including the failure of the Company’s Board to recommend approval by the stockholders of the Bison Transaction or approval by the Company’s Board of a Superior Proposal under certain circumstances, or if the stockholders do not approve this Proposal Four or Proposal Five, the Company is required to pay to Bison a termination fee equal to $1,000,000.

If the Stock Purchase Agreement is terminated by the Company as a result of Bison’s breach of any representation or warranty or failure to perform in any material respect any covenant or agreement that would cause any of the closing conditions not to be satisfied, subject to certain timing requirements and opportunities to cure or if the closing conditions are met and the Company is ready and willing to consummate the Bison Transactions and Bison fails to consummate the Bison Transaction, Bison is required to pay to the Company a termination fee of $1,000,000.

We expect that Christopher J. McGurk, the Company’s Chairman and Chief Executive Officer, may acquire 333,333 shares of Class A Common Stock as part of the Bison Transaction, and that Mr. McGurk will pay for those shares by surrendering to the Company the $500,000 principal amount of Second Lien Notes he currently holds. In addition, other members of management may acquire some or all of the other 3,000,000 shares of Class A Common Stock that may be sold to management as part of the Bison Transaction, and that they will pay cash for such shares. All such shares of Class A Common Stock sold to management will be sold at the same price, $1.50 per share, as the Bison Shares will be sold. For purposes of this Proposal Four, the Company is seeking stockholder approval for the issuance of up to 3,333,333 shares of Class A Common Stock (which shares are part of the 20,000,000 shares to be issued and sold pursuant to the Stock Purchase Agreement), which represents the maximum number of shares of Class A Common Stock that may be sold to management as part of the Transactions.

The Exchange Agreements provide for the holders of Convertible Notes to exchange their Convertible Notes for cash and shares of Common Stock at a ratio of $350 in cash and 73.33 shares of Common Stock per $1,000 of Notes (the “Exchange Ratio”). One Exchange Agreement also provided for the holder party thereto to exchange $1,827,000 principal amount of its Notes for $1,462,000 principal amount of Second Lien Notes, which exchange occurred shortly after execution of the Exchange Agreement, and prior to any other exchanges with such holder. All Convertible Notes, other than those Convertible Notes exchanged for Second Lien Notes, may be surrendered by any holder party to an Exchange Agreement in exchange for the Common Stock portion of the Exchange Ratio. Through July 24, 2017, holders of Convertible Notes have exchanged $3,650,000 principal amount of their Convertible Notes for 1,215,326 shares of Common Stock (exclusive of fractional shares). Holders of Convertible Notes may continue to surrender Convertible Notes in exchange for Common Stock periodically until the closing of the Transactions; however, prior to closing the Transactions, the Company shall not issue more than 2,476,031 shares of Common Stock, which equals 19.99% of the Common Stock of the Company outstanding as of the date of signing the Exchange Agreements (the “Interim Issuance Limit”). At the closing of the Transactions, the holders will exchange all of their remaining Convertible Notes for cash and shares such that all of the exchanges with such holders (other than the exchange for Second Lien Notes), in the aggregate, reflect the Exchange Ratio.

The Company has agreed with certain holders that the number of shares of Common Stock deliverable at closing of the Transactions is subject to reduction in the event the volume weighted average price of the Common Stock for the 15 business days prior to the closing of the Transactions (the “Reference Price”) is greater than $2.50, in which case the number of shares of Common Stock deliverable is reduced by multiplying the shares deliverable to such holder by a fraction equal to $2.50 divided by the Reference Price. Unless the number of shares is reduced as described, the aggregate number of shares of Common Stock that may be issued pursuant to the Note Exchanges is 3,536,792 shares. For purposes of this Proposal Four, the Company is seeking stockholder approval for the issuance of 1,060,761 shares of Class A Common Stocks, which represents the maximum number of shares of Common Stock issuable pursuant to the Exchange Agreements in excess of the Interim Issuance Limit. The Note Exchanges may be terminated under certain circumstances, including if the Bison Transaction is not closed by October 31, 2017, and by each holder as to its rights and obligations if the Stock Purchase Agreement is terminated in accordance with its terms or upon the breach of a certain covenant under the Exchange Agreements.

Why We Are Seeking Stockholder Approval

The issuance of shares in the Transactions is being submitted to the stockholders at the Annual Meeting to comply with the stockholder approval requirements of NASDAQ Rule 5635.

Under NASDAQ Rule 5635(b), companies that have securities listed on NASDAQ must obtain stockholder approval prior to the issuance of common stock when the issuance or potential issuance would result in a “change of control” as defined by NASDAQ (the “Change of Control Rule”). NASDAQ generally characterizes a transaction whereby an investor or group of investors acquires, or obtains the right to acquire, 20% or more of the voting power of an issuer on a post-transaction basis as a “change of control” for purposes of Rule 5635(b).

Under NASDAQ Rule 5635(c), companies that have securities listed on NASDAQ must obtain stockholder approval prior to the issuance of common stock to officers, directors, employees, or consultants at a price less than the greater of the book and market value per share of such common stock, as such issuance is deemed to be compensatory (the “Equity Compensation Rule”).

Under NASDAQ Rule 5635(d), companies that have securities listed on NASDAQ must obtain stockholder approval prior to the issuance of common stock in a private offering at a price less than the greater of the book and market value per share of such common stock, if the issuance amounts to twenty percent (20%) or more of the common stock or twenty percent (20%) or more of the voting power of a company outstanding before the issuance (the “20% Rule”).

The Company’s Board of Directors has submitted this Proposal Four to the Company’s stockholders for approval because the Change of Control Rule, the Equity Compensation Rule and the 20% Rule apply to issuance of the Company’s Class A Common Stock in the Transactions.

As of the date of this proxy statement, the Company had issued and outstanding 13,611,679 shares of Class A Common Stock. If the Company consummates the Transactions and sells all 20,000,000 shares of Common Stock to Bison, and assuming the issuance of the 3,526,792 Exchange Shares in the Note Exchanges, Bison would acquire shares representing approximately 55.7% of the outstanding Class A Common Stock of the Company. If the Company’s management purchases 400,000 shares of Class A Common Stock and Bison acquires 19,600,000 shares of Class A Common Stock, and assuming the issuance of the 3,526,792 Exchange Shares in the Note Exchanges, Bison would acquire shares representing approximately 54.6% of the outstanding shares of the Company.

The approval sought under this Proposal Four will be effective to satisfy the stockholder approval requirements of the Change of Control Rule, the 20% Rule and the Equity Compensation Rule. Under the NASDAQ Rule 5635, the minimum vote which will constitute stockholder approval of this Proposal Four for the purposes of the Change of Control Rule, the 20% Rule and the Equity Compensation Rule is a majority of the total votes cast on the proposal in person or by proxy at the Annual Meeting.

Background and Purpose of the Transactions

Need for Financing

The purpose of the Transactions is to raise the capitalmost appropriate policy for the Company at this time and recommends that stockholders vote for future advisory votes on executive compensation to reduce the principal amount outstanding,occur every year. Voting every year, rather than every two or enable the complete elimination, of the Convertible Notes.

The Company has built a solid platform for growth; however, historically it has not had the ability to fund its expanding operations through its own cashflow. The Company believes that the capital infusion that would result if the Transaction is consummated would alleviate ongoing problem andthree years, will provide adequate capital to do so. Such funding is expected to enable the Company to fund its future growth strategies in the developing over-the-top (“OTT”) space, in which the Company hopes to launch more owned and third party channels, as well as continue to fund the growth in its subscriber base. The Company also hopes to acquire highly profitable quality content to expand its distribution pipeline on two levels: individual properties and the licensing of full libraries of content, which would be available for all Company methods of distribution including theatrical limited releases, all areas of physical and digital distribution, and finally to our OTT platforms. The Company believes that the Bison Transaction would provide both needed capital and a valuable strategic partner, which factor is described further below under the caption “Background and Purpose of the Transactions - Strategic Partnership.”

In addition to raising capital through the Bison Transaction, the Company intends to eliminate a substantial portion of indebtedness by reducing or enabling the complete elimination of the outstanding Convertible Notes. The Exchange Agreements relate to $50,571,000 in principal amount of Convertible Notes, which constitute 99% of the outstanding principal amount of the Convertible Notes. After completion of the Note Exchanges, only $515,000 principal amount of the Convertible Notes would remain outstanding. The consummation of the Bison Transaction would result in a “Fundamental Change” under the terms of the Convertible Notes because Bison Capital would become the beneficial owner (as defined under Rule 13d-3 promulgated under the Exchange Act) of Class A Common Stock that represents over 50% of the voting power of the Company’s voting securities. Upon a Fundamental Change, any holder of outstanding Convertible Notes shall have the right to require the Company to repurchase any or all of its Convertible Notes for cash at a repurchase price equal to 100% of the principal amount of such Convertible Notes plus accrued and unpaid interest thereon. Accordingly, upon consummation of the Transactions, the Company expects to reduce the outstanding principal amount of Convertible Notes to $515,000 pursuant to the Note Exchanges, and subsequently may eliminate this remaining amount entirely. The Note Exchanges will result in a significant reduction of outstanding debt for the Company, reducing the Company’s total debt and interest costs, and improving its liquidity and financial condition.

The Company’s financial condition and results of operations are discussed in detail in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2017, which is included in the Annual Report to Stockholders that accompanies this proxy statement.

Strategic Partnership

The Company believes it enjoys a leading position within the United States market, and has identified growth internationally as a strategic priority. China represents a high growth emerging market with an enormous number of potential consumers and users of the Company’s products, including OTT channels. Bison Capital has established itself in the media, entertainment and related technology markets in China, having made several successful investments in film and television production, film distribution and internet-related mobile internet services. Bison Capital is led by practiced executives with experience in the media markets both in China and globally. Bison Capital has expressed to the Company its intention to assist the Company with expanding its content and entertainment business, including OTT channels, into China, including obtaining relevant licenses, which Bison Capital has previously been successful in obtaining for other media companies, as well as potentially launching Chinese content OTT channels in the United States. The Board and our management believe that Bison Capital’s support in these areas could provide valuable assistance in the growth, development and success of the Company’s business.

History of Seeking Strategic Investment or Partnership

In light of the Company’s ongoing need for capital to fund operations and grow its content and entertainment business, including acquiring content and developing OTT channels, the Company has sought investment from suitable partners since inception, both with respect to financing and strategic partnership opportunities. Over the past several years, management engaged in numerous conversations without reaching acceptable terms with any investor or strategic partner prior to agreeing to the Transactions. During the discussions with Bison Capital, the Board concluded that both Bison Capital’s financing capability and the global experience in our industry would be beneficial to the Company, and presented an opportunity that was more attractive than other parties that would be able to offer only one of those elements alone.

Determination of Purchase Price

The purchase price for the Bison Shares will be $1.50 per share. This price per share was determined during the negotiations (and prior to signing the Stock Purchase Agreement) with Bison Capital. At the time of such determination, $1.50 per share constituted a slight premium to the then-current price of the Class A Common Stock based on the 10-day average price of the Class A Common Stock at such time.

With respect to the $1.50 share price, the Board took many factors into consideration, including the price of the Class A Common Stock on Nasdaq at the time, potential dilution, the proposed convertible exchanges, the possible strategic opportunity with Bison, access to liquidity and the limited trading volume of the Class A Common Stock. The Board specifically looked at the Company’s ongoing need for capital, alongstockholders with the opportunity to retire debt at a substantial discount. The Company, after balancingreview the various factors, believes that the $1.50 is a better priceCompany’s compensation program annually and make any desired adjustments, rather than could have been achieved if it had raised capital via an equity offering, which typically sells at a discountwaiting for two or three years to market and may have included warrant coverage or other features. After considering these factors, the Board concluded that the pricing for the shares was fair and in the best interests of the Company and its stockholders.make any desired changes.

Use of Proceeds

The proceeds from the sale of the Bison Shares will be used for cash portions of the Note Exchanges, the payment of fees and expenses incurred in connection with the Transactions, and working capital and general corporate purposes, which may include the payment of additional outstanding debt obligations and development of OTT channels and acquisition of content for our content and entertainment business.

Dilution

If this Proposal Four is approved and the Company consummates the Transactions, the Company’s existing stockholders, basedThis advisory vote on the numberfrequency of shares of Class A Common Stock outstanding as of the Record Date, would hold 34.5% of the Company’s outstanding capital stock and would have relatively little influence over the Company’s affairs.

If Proposal Eightfuture advisory votes on executive compensation is approved and the Company adopts the 2017 Equity Incentive Plan, the Company would reserve another 1,980,000 shares of Class A Common Stock for issuance thereunder, which would later result in additional dilution to the Company’s existing stockholders.

Effect on Outstanding Warrants

The Company currently has outstanding warrants to purchase an aggregate of 452,500 shares of Class A Common Stock, with varying terms. Some of these warrants contain anti-dilution adjustment provisions that will be triggered by the consummation of the Transactions. If this Proposal Four is approved and the Company consummates the Transactions, there will be anti-dilution adjustments resulting in an additional 15,115 shares of Class A Common Stock becoming issuable upon the exercise of such warrants.

In addition, the Company currently has outstanding warrants to purchase an aggregate of 125,063 shares of Class A Common Stock, with varying terms. Some of these warrants contain anti-dilution adjustment provisions that will be triggered by the consummation of the Transactions. If this Proposal Four is approved and the Company consummates the Transactions, there will be anti-dilution adjustments resulting in additional shares of Class A Common Stock becoming issuable upon the exercise of such warrants, although such addition number will vary basednon-binding on the stock price of the Class A Common Stock at the time of the closing. If the stock price at the time of closing is $1.49 (the closing price of the Class A Common Stock on the Record Date), 14,661 additional shares of Class A Common StockBoard. Stockholders will become issuable upon the exercise of such warrants.

Effect on Forward Stock Purchase Contract Shares

In April 2015, in connection with the issuance of the Convertible Notes, the Company entered into a forward stock purchase transaction (the “Forward Stock Purchase Transaction”) pursuant to a forward stock purchase confirmation (the “Forward Stock Purchase Confirmation”) with Société Générale (the “Forward Counterparty”), pursuant to which the Company purchased 1,179,138 (as adjusted for the Company’s 1-for-10 reverse stock split in May 2016) shares (the “Forward Stock Purchase Shares”) of its Class A common stock for settlement on or about the fifth anniversary of the issuance of the Convertible Notes. The Forward Stock Purchase Transaction was generally expected to facilitate privately negotiated derivative transactions between the Forward Counterparty and holders of the Convertible Notes, including swaps, relating to the shares of Class A common stock by which holders of the Notes have established short positions relating to the shares of Class A common stock and otherwise hedged their investments in the Convertible Notes. The Forward Stock Purchase Transaction is subject to early settlement, in whole or in part, at any time prior to the final settlement date at the option of the Forward Counterparty. The Forward Stock Purchase Shares are treated as retired for certain accounting purposes as of the effective date of the Forward Stock Purchase Confirmation, but remain outstanding for corporate law purposes, including for purposes of stockholder votes. Upon settlement, the Forward Stock Purchase Shares may be retired and held in treasury, in which case they are no longer deemed to be outstanding. It is expected that the Forward Stock Purchase Shares will be settled upon the cancellation of Convertible Notes pursuant to the Note Exchanges, and that all or substantially all of the Forward Stock Purchase Shares will be retired and held in treasury at or shortly after the consummation of the Transactions. As of July 31, 2017, 325,000 of the Forward Stock Purchase Shares have been settled.

Effect on Net Operating Losses

The issuance of the Shares in the Transactions is expected to result in an ownership change as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”). In general, under Section 382 of the Code, an ownership change occurs if, immediately after any “owner shift” involving a “5-percent shareholder” or any “equity structure shift” the percentage of the stock of the corporation owned by one or more 5-percent shareholders has increased by more than 50 percentage points over the lowest percentage of stock of the corporation (or any predecessor corporation) owned by such shareholders at any time during a three-year testing period. If a Section 382 ownership change were to occur, there would be a substantial limitation on the Company’s ability to utilize its existing net operating loss carryforwards (“NOL carryforwards”) to offset future taxable income.

As of March 31, 2017, the Company had approximately $250.3 million of NOL carryforwards for federal income tax purposes. The US federal and state NOL carryforwards will begin to expire in 2020. The impact of an ownership change on state NOL carryforwards may vary from state to state. As of March 31, 2017, approximately $12.6 million of our net operating loss from periods prior to March 2006 are subject to a Section 382 limitation. Net operating losses of approximately $237.7 million, which were generated since March 2006 are currently not subject to an annual limitation under Section 382. The annual limitation for a corporation’s NOL carryforwards following an ownership change generally equals the product of the corporation’s value immediately prior to the ownership change and the “long-term tax-exempt” rate of interest (which is 2.04% for ownership changes occurring in July, 2017). If the Transactions are consummated, the effect on the existing NOLs will be to limit them to an annual amount equal to the product of the Company’s market capitalization immediately prior to the Transactions and 2.04%, with certain adjustments (except that the limitation for previously limited NOL carryforwards will be the lesser of the prior limitation and the limitation triggered by the Transactions).

It is expected that the Note Exchanges will trigger cancellation of indebtedness income, because it is expected that the sum of the cash and the fair market value of the stock to be received by the Note holders in exchange for their Notes will be less than the “adjusted issue price” (generally, unpaid principal and interest) of the Notes. Provided, however, that the Note Exchanges all occur on or before the date of the issuance of Shares in the Transactions, the Company may be able to offset the resulting cancellationspecify one of indebtedness income with NOL carryforwards, without being subject to any Section 382 limitation created by the Transactions. In general, a corporation with NOL carryforwards may elect to allocate its net operating loss or taxable income such that cancellation of indebtedness income recognized on or before the date of an ownership change is treated as arising prior to the ownership change. In the case of cancellation of indebtedness income arisingfour choices for this proposal on the day of an ownership change, it is possible that the IRS would take the position that it should be treated as “recognized built-in gain” (“RBIG”) rather than as income allocable to the pre-ownership change period. Treating cancellation of indebtedness income as RBIG can have the same result as treating it as pre-ownership change income, since, to the extent that such income is treated as RBIG on the ownership change date, it can increase a corporation’s Section 382 limitation, subject to a “net unrealized built-in gain” limitation.

In structuring the Transactions, the Company sought to preserve as much use of its NOLs as possible by taking advantage of the rules described in the preceding paragraph, but the remaining NOLs will be severely impaired following the consummation of the Transactions. There is no assurance, however, that the Company will generate taxable income in the future against which the NOLs could be applied.

Dissenters’ Rights

Under Delaware law, stockholdersproxy card: one year, two years, three years or abstain. Stockholders are not entitled to dissenters’ rights with respect to the transactions contemplated by this Proposal Four.

Impact if Proposal Four is Not Approved

The sale of Bison Shares in the Transactions is contingent upon the approval of the Company’s stockholders of this Proposal Four.

If the Company is unable to complete the sale of the Bison Shares in the Transactions, then the Company intends to seek alternative funding. However, the Company is uncertain whether the alternative funding would be available, or if available, whether it would be on terms less favorable to the Company or would be available to the Company quickly enough to provide for the Company’s capital needs. If the Company is unsuccessful in obtaining additional funding on acceptable terms or at all, then the Company would have to significantly or substantially curtail its spending and operations, in which case the Company’s current stockholders and investors may lose their entire investments.

If the Transactions are not consummated, then the interim exchanges of Convertible Notes already effected at such time would remain in place but no additional exchanges of the remaining Convertible Notes of the participating holders would be effected. Accordingly, $45,043,000 or more principal amount of Convertible Notes would remain outstanding and would not be extinguished.

Vote Required

Under the NASDAQ Rules, the minimum vote which will constitute stockholder approval of this Proposal Four for the purposes of NASDAQ Rule 5635 is the affirmative vote of a majority of the total votes cast on this Proposal Four.

Assuming the existence of a quorum, Proposal Four will be approved if the number of shares voted in favor of the proposalvoting to approve or disapprove the issuance of Shares inBoard’s recommendation. Although non-binding, the Transactions exceedsBoard and the number of shares voted againstCompensation Committee will carefully review the proposal. As such, abstentionsvoting results. Notwithstanding the Board’s recommendation and broker non-votes will not affect the outcome of the stockholder vote, but will be counted for determining the existenceBoard may in the future decide to conduct advisory votes on a more or less frequent basis and may vary its practice based on factors such as discussions with stockholders and the adoption of a quorum.

If this Proposal Four is approved but Proposal Five is not approved or any of Proposal Six, Proposal Seven and Proposal Eight is not approved or the requirements therefor are not waived by Bison Capital, the Transactions will not be consummated.

Even if this Proposal Four is approved by stockholders, the failurematerial changes to satisfy or have waived other conditions to consummating the Transactions could prevent the Transactions from being consummated.compensation programs.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERSSHAREHOLDERS VOTE “FOR” THE PROPOSAL TO APPROVE THE CHANGE OF CONTROL STOCK ISSUANCE TRANSACTIONCONDUCT FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY YEAR.

PROPOSAL FOUR

PROPOSAL FIVE

AMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION TO

2017 EQUITY INCENTIVE PLAN TO INCREASE THE AMOUNTTOTAL NUMBER OF SHARES OF CLASS A COMMON STOCK AUTHORIZEDAVAILABLE FOR ISSUANCE THEREUNDER

Our Board adopted the Company's 2017 Equity Incentive Plan ("the Plan"), on August 7, 2017 and, in on August 31, 2017, our stockholders approved the Plan at an annual meeting of stockholders. Under the Plan, we may grant incentive and nonqualified stock options, stock, restricted stock, restricted stock units ("RSUs"), stock appreciation rights ("SARs"), performance awards including performance stock units (“PSUs”) and other equity-based awards. The Plan is administered by the Compensation Committee and currently has an expiration date of August 31, 2027.

The Company’s Certificate of IncorporationPlan currently authorizes the issuance of a total of 41,241,000up to 2,098,270 shares of capital stock. Of such shares, 25,000,000 are designated as Class A Common Stock; 1,241,000 are designated as Class B Common Stock; and 15,000,000 are designated as preferred stock. As of July 24, 2017, there were 13,611,679 shares ofthe Company's Class A Common Stock issued and outstanding. Asfor issuance pursuant to awards made under the Plan. The Company believes that the availability of July 24, 2017, there were noan additional 2,000,000 shares of Class B Common Stock issued and outstanding, and no remaining shares of Class B Common Stock available for issuance. With respect to the 15,000,000 shares of authorized preferred stock, 20 are designated as Series A 10% non-voting cumulative preferred stock, of which seven (7) are issued and outstanding and one (1) was issued but is no longer outstanding, and 1,000,000 are designated as Series B Junior Participating Preferred Stock, none of which are issued or outstanding.

In addition to the 13,611,679 shares ofCompany's Class A Common Stock currently outstanding, the Company has 5,399,572 shares of Class A Common Stock reserved for issuance pursuant to (a) the exercise of outstanding warrants, (b) the Company’s Second Amended and Restated Equity Incentive Plan (the “Plan”), including outstanding stock options granted thereunder, (c) the exercise of outstanding inducement stock options that were granted outside of the Plan, and (d) the conversion of the Company’s 5.5% Convertible Notes.

The aggregate number of outstanding and reserved shares of Class A Common Stock is 19,011,251, leaving only 5,988,749 shares of Class A Common Stock available for future issuances. Such future issuances could include the sale of securities in order to raise capital, the payment of consideration in acquisitions, additional shares issued in connection with grants made to employees under new or expanded existing compensation plans or arrangements, and other uses not currently anticipated. Specifically, if this Proposal Five and Proposals Four and Eight are approved and the Transactions are consummated, the Company will issue 23,526,792 Shares in connection therewith and reserve 1,980,000 shares in connection with the 2017 Equity Incentive Plan. Accordingly, the Company is proposing to increase the number of authorized shares of Class A Common Stock, so that the number of shares of Class A Common Stock would increase to 60,000,000 shares. This would allow the Company to issue the Shares upon consummation of the Transactions, reserve shares for issuance under the 2017 Equity Incentive Plan and have additional shares of Class A Common Stock available for future uses, although no such future uses are contemplated at this time. If this Proposal Five is approved, Proposal Four is approved and Proposal Six, Proposal Seven and Proposal Eight are approved or the requirements therefor under the Stock Purchase Agreement are waived by Bison Capital, the Company intends to file, in connection with the consummation of the Transactions, an amended and restated Certificate of Incorporation to effect the change proposed by this Proposal Five, a copy of which is attached hereto asAppendix A. The Company believes that such increase is in the best interests of the Company and its stockholders as it would allowbecause the availability of an adequate equity incentive program is an important factor in attracting and retaining qualified officers, directors and employees essential to the success of the Company to consummate the Transactions(whether through acquisitions or otherwise) and in addition, provide the Companyaligning their long-term interests with flexibility and alternatives in structuring future transactions.

This amendment would not change anythose of the rights, restrictions, terms or provisions relating to the Class A Common Stock or the preferred stock. Under the General Corporation Law of the State of Delaware, stockholders are not entitled to appraisal rights with respect to this amendment.stockholders. The Company will not independently provide stockholders with any such right. Additionally, holders of Class A Common Stock do not have any preemptive rights with respect to the issuance of Class A Common Stock.

Future issuances of Class A Common Stock could affect stockholders. Any future issuance of Class A Common Stock, other than on a pro-rata basis, would dilute the percentage ownership and voting interest of the then current stockholders.

At the Company’s 2016 Annual Meeting of Stockholders (the “2016 Meeting”), the Board sought the approval of stockholders of a proposal to increase in the number of authorized shares of Class A Common Stock from 21,000,000available for issuance under the Plan will permit the Company to 25,000,000 (the “2016 Proposal”). The proxy statementcontinue the operation of the Plan for the 2016 Meeting incorrectly referredbenefit of new participants (either new hires to current operations or employees of acquired companies), as well as to allow additional awards to current participants. Participants under the Plan may include officers, directors and employees of the Company, as well as consultants to the 2016 Proposal as a “non-routine” matter, and also stated that brokers would not be allowed to vote on the 2016 Proposal and other non-routine matters without instructions from beneficial owners. The NYSE, which determines whether proposals are routine or non-routine (and, therefore, whether brokers who did not receive instructions from beneficial owners of shares may vote such shares for such proposal), subsequently determined that the 2016 Proposal was a “routine” matter, for which brokers could vote uninstructed shares. For a description of voting on “non-routine” matters, see “Quorum; Abstentions; Broker Non-Votes” on page 3.Company under certain circumstances.

Pursuant to the NYSE’s determination that the 2016 Proposal was a routine matter, shares voted by brokers who received no instructions from beneficial owners were treated as “for” votesthis proposal, in the vote tabulation, instead of having the same effect as a vote “against” the 2016 Proposal. Inclusionform of the “for” votes inamendment attached hereto as Appendix A, the tabulation resulted in sufficient votesBoard proposes to approveamend the 2016 Proposal. We have neither issued nor reservedPlan to increase the number of shares of Class A Common Stock in excess ofauthorized for issuance under the 21,000,000 shares that were authorized priorPlan from 2,098,270 to the 2016 Proposal. We recognize that the disclosure associated with that vote could have resulted in confusion about the effect of a stockholder’s failure to give specific voting instructions for the 2016 Proposal; but no stockholder was impacted by the 2016 Proposal, as none of such additional shares have been used. We acknowledge that a stockholder has objected to the increase effected pursuant to the 2016 Proposal and asserts that such increase was not valid. We believe that this Proposal Five to increase the number of authorized shares of Class A Common Stock will resolve any concern about the approval of the 2016 Proposal, as this Proposal Five seeks stockholder approval of an increase in the number of shares to a larger overall number of authorized shares than that requested in the 2016 Proposal.4,098,270.

Based upon NYSE guidance, we have characterized this Proposal Five as a “non-routine” matter because it relates to an amendment to a certificate of incorporation to increase the authorized shares in order to enable the consummation of a specific transaction. Accordingly, broker non-votes will not be counted as “for” this Proposal Five.

If Proposal Four is approved, this Proposal Five is approved and Proposal Six, Proposal Seven and Proposal Eight are approved or the requirements therefor under the Stock Purchase Agreement are waived by Bison Capital and the Transactions are consummated, approximately 23,526,892 Shares will be issued, which will be dilutive with respect to the percentage ownership and voting interest of the holders of outstanding shares of Class A Common Stock. The Company’s existing stockholders would hold 34.5% of the Company’s outstanding capital stock and would have relatively little influence over the Company’s affairs.

If this Proposal Five is approved, regardless of whether the other proposals presented in the proxy statement are approved, the Company will amend the Certificate of Incorporation to increase the number of authorized shares of Class A Common Stock to 60,000,000 unless the Board determines otherwise.

This proposal requires approval by a majority of the votes entitled to voteVotes Cast at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL AMEND THE COMPANY’S CERTIFICATE OF INCORPORATION TO INCREASE THE AMOUNT OF CLASS A COMMON STOCK AUTHORIZED.

PROPOSAL SIXAMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION TOELIMINATE THE SHARE TRANSFER RESTRICTIONS IN SECTION 4.4

The Board is seeking your approval of an If approved by stockholders, the proposed amendment to the Company’s Certificate of Incorporation to remove restrictions on the transfer of its securities under certain circumstances (the “NOL Protective Provision”). The NOL Protective Provision prevents certain direct and indirect future transfers of our capital stock that could adversely affect our ability to utilize our net operating loss carryforwards (“NOL” carryforwards) and certain income tax credits to reduce our federal income taxes.

The issuance of the Shares in the Transactions is expected to result in an ownership change as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”). In general, under Section 382 of the Code, an ownership change occurs if, immediatelyPlan would become effective promptly after any “owner shift” involving a “5-percent shareholder” or any “equity structure shift” the percentage of the stock of the corporation owned by one or more 5-percent shareholders has increased by more than 50 percentage points over the lowest percentage of stock of the corporation (or any predecessor corporation) owned by such shareholders at any time during a three-year testing period. If a Section 382 ownership change were to occur, there would be a substantial limitation on the Company’s ability to utilize its existing NOL carryforwards to offset future taxable income.

approval. As of March 31, 2017, the CompanyOctober 15, 2019, 235,862 shares had approximately $250.3 million of NOL carryforwards for federal income tax purposes. The US federal and state NOL carryforwards will begin to expire in 2020. The impact of an ownership change on state NOL carryforwards may vary from state to state. As of March 31, 2017, approximately $12.6 million of our net operating loss from periods prior to March 2006 are subject to a Section 382 limitation. Net operating losses of approximately $237.7 million, which were generated since March 2006 are currently not subject to an annual limitation under Section 382. The annual limitation for a corporation’s NOL carryforwards following an ownership change generally equals the product of the corporation’s value immediately prior to the ownership change and the “long-term tax-exempt” rate of interest (which is 2.04% for ownership changes occurring in July, 2017). If the Transactions are consummated, the effect on the existing NOLs will be to limit them to an annual amount equal to the product of the Company’s market capitalization immediately prior to the Transactions and 2.04%, with certain adjustments (except that the limitation for previously limited NOL carryforwards will be the lesser of the prior limitation and the limitation triggered by the Transactions).

The NOL Protective Provision restricts the ability of existing and future stockholders to acquire additional shares of Common Stock or transfer such shares to another party to the extent that such acquisition or transfer would create or result in an individual or entity becoming a holder of 5% or more of the then outstanding Common Stock or increase the ownership percentage of an existing holder of 5% or more of the then outstanding Common Stock.

If the Transactions are consummated, an ownership change under Section 382 is expected to occur and our NOLs are expected to be severely impaired. However, the Company believes that it will not continue to generate significant NOLs going forward based on the performance of both the digital cinema and content and entertainment businesses. In addition, while a future ownership change might potentially subject the Company’s NOL carryforwards to an additional limitation, the preservation of the Company’s NOLs, as limited by the Section 382 limitation expected to be triggered by the Transactions, may not be as important to the Company.

The NOL Protective Provision is contained in Article Fourth to our current Fourth Amended and Restated Certificate of Incorporation, as amended, and is attached asAppendix B to this Proxy Statement. The removal of the NOL Protective Provision will only become effective if this Proposal Six is approved, Proposal Four and Proposal Five are approved and Proposal Seven and Proposal Eight are approved or the requirements thereforbeen issued under the Stock Purchase Agreement are waived by Bison Capital,Plan (upon stock grants and settlements of RSU grants) and PSU grants under the Transactions are consummated.

This proposal requires approval by a majority of the votes entitled to vote at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO AMEND THE COMPANY’S CERTIFICATE OF INCORPORATION TO ELIMINATE THE SHARE TRANSFER RESTRICTIONS IN SECTION 4.4.

PROPOSAL SEVENAMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION TOELIMINATE THE CLASS B COMMON STOCK ANDTHE SERIES B JUNIOR PARTICIPATING PREFERRED STOCK

The Company’s Certificate of Incorporation currently authorizes the issuance of a total of 41,241,000 shares of capital stock. Of such shares, 25,000,000 are designated as Class A Common Stock; 1,241,000 are designated as Class B Common Stock; and 15,000,000 are designated as preferred stock. As of July 24, 2017, there were 13,611,679Plan covering 1,361,867 shares of Class A Common Stock issued and outstanding. Aswere outstanding, all of July 24, 2017, there were nowhich may be settled in cash or in shares of Class BA Common Stock issued and outstanding, and no remainingat the company’s discretion. If all such PSU grants are settled in cash, only 1,862,408 shares of Class B Common Stockwould remain available for issuance. With respect tofuture grants under the 15,000,000 shares of authorized preferred stock, 20 are designated as Series A 10% non-voting cumulative preferred stock, of which seven (7) are issued and outstanding and one (1) was issued but is no longer outstanding, and 1,000,000 are designated as Series B Junior Participating Preferred Stock, none of which are issued or outstanding.

The Board is seeking your approval of anPlan. If the proposed amendment to the Company’s Certificate of Incorporation to eliminate Class B Common Stock, which has no more shares available for issuance, and to reclassify the 1,000,000 shares of Series B Junior Participating Preferred Stock as undesignated preferred stock.

If this Proposal Seven, Proposal Four and Proposal Five arePlan is not approved, and Proposal Six and Proposal Eight are approved or the requirements therefor under the Stock Purchase Agreement are waived by Bison Capital, and the Transactions are consummated and the Amended and Restated Certificate of Incorporation is filed with the Secretary of State of the State of Delaware, each share of our Common Stock designated as Class B Common Stock will automatically be eliminated and each share of our Series B Junior Participating Preferred Stock will automatically be reclassified into one share of undesignated preferred stock. The reclassified shares of Series B Junior Participating Preferred Stock will have no designation of rights or preferences and such rights and preferences may be designated in the future in the same manner and method as set forth in our Amended and Restated Certificate of Incorporation for existing undesignated preferred stock. If this Proposal Seven is approved, regardless of whether the other proposals presented in the proxy statement are approved, the Company will amend the Certificate of Incorporation to eliminate the Class B Common Stock and the Series B Junior Participating Preferred Stock, unless the Board determines otherwise.

This proposal requires approval by a majority of the votes entitled to vote at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO AMEND THE COMPANY’S CERTIFICATE OF INCORPORATION TO ELIMINATE THE CLASS B COMMON STOCK AND THE SERIES B JUNIOR PARTICIPATING PREFERRED STOCK.

PROPOSAL EIGHT

APPROVAL OF 2017 EQUITY INCENTIVE PLAN

The Company is asking its stockholders to approve the 2017 Equity Incentive Plan (the “Plan”), the Company’s new equity incentive plan. If approved by stockholders, the Plan will replace the Cinedigm Second Amendedcontinue as currently in effect unless and Restated 2000 Equity Incentive Plan, asuntil otherwise amended and restated to date (the “2000 Equity Incentive Plan”) for employees of, and consultants to, the Company. Approval of the Plan shall not affect awards already granted under the 2000 Incentive Plan.

A copy of the Plan is attached asAppendix C to this Proxy Statement. The following is a summary of the material features of the Plan and is qualified in accordance with its entirety by reference to the Plan. Capitalized terms not otherwise defined are used as set forth in the Plan.terms.

Administration